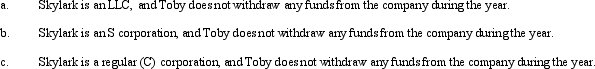

During the current year,Skylark Company had operating income of $420,000 and operating expenses of $250,000.In addition,Skylark had a long-term capital loss of $20,000,and a charitable contribution of $5,000.How does Toby,the sole owner of Skylark Company,report this information on his individual income tax return under following assumptions?

Definitions:

Viruses

Infectious agents that replicate only inside the living cells of an organism, can affect all types of life forms, from animals and plants to microorganisms.

Huntington's Disease

A genetic neurodegenerative disorder that causes the progressive breakdown of nerve cells in the brain, leading to motor control problems, psychiatric symptoms, and cognitive decline.

Dominant Inheritance

A pattern of inheritance where an allele is expressed in the phenotype even in the presence of a different allele.

Reproductive Age

The period in an individual's life during which they are biologically capable of reproducing offspring.

Q1: A person who is very self-conscious and

Q3: Which of these is not a part

Q5: Hamilton suggested inclusive fitness, while Darwin suggested

Q21: At the foundation of the concept of

Q27: Seven years ago,Paul purchased residential rental estate

Q30: Freud based his psychoanalytic theory on<br>A) laboratory

Q46: Under certain circumstances,a distribution can generate (or

Q56: Which of the following statements regarding a

Q76: A cash basis calendar year C corporation

Q101: The Schedule M-3 is the same for