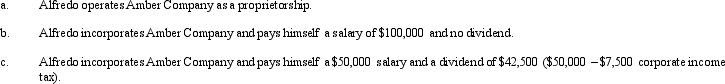

Amber Company has $100,000 in net income in 2013 before deducting any compensation or other payment to its sole owner,Alfredo.Assume that Alfredo is in the 33% marginal tax bracket.Discuss the tax aspects of each of the following independent arrangements.(Assume that any salaries are reasonable in amount and ignore any employment tax considerations.)

Definitions:

Trademarked

A symbol, word, or phrase legally registered or established by use as representing a company or product.

Copyrighted

Describes material, such as text, music, or artwork, that is legally protected from unauthorized use without permission from the owner.

Business Plan

A document describing a business that is used to test the feasibility of a business idea, to raise capital, and to serve as a road map for future operations.

Clayton Act

A U.S. antitrust law enacted in 1914, aimed at promoting fair competition and preventing unfair business practices such as price discrimination, anti-competitive mergers, and exclusive dealing contracts.

Q1: Even if property tax rates are not

Q22: Maslow describes concentration, growth choices, self-awareness, honesty,

Q34: Which of these has nothing to do

Q40: Which of these statements is TRUE?<br>A) Cognitive

Q47: An S shareholder's stock basis does not

Q77: Brett owns stock in Oriole Corporation (basis

Q77: Kilps,a U.S.corporation,receives a $200,000 dividend from a

Q78: Which of the following statements is false

Q97: Olaf,a citizen of Norway with no trade

Q126: AirCo,a domestic corporation,purchases inventory for resale from