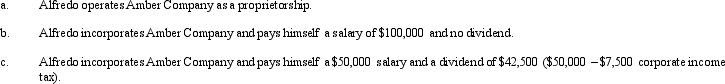

Amber Company has $100,000 in net income in 2013 before deducting any compensation or other payment to its sole owner,Alfredo.Assume that Alfredo is in the 33% marginal tax bracket.Discuss the tax aspects of each of the following independent arrangements.(Assume that any salaries are reasonable in amount and ignore any employment tax considerations.)

Definitions:

Assertive

The quality of being confidently aggressive or self-assured in stating one's opinions without being aggressive.

Unfazed by Stress

Remaining calm and not being easily disturbed or stressed by challenging situations.

High-Pressure Circumstances

Scenarios or situations characterized by elevated stress levels, urgency, or demanding conditions that require immediate attention or action.

Religious Services

Ceremonial acts of worship and devotion observed within a religious tradition.

Q6: Which of the following is NOT a

Q18: Roseau argued that humans are born fundamentally

Q18: Rogers saw people caught in a conflict

Q26: Raymond Cattell used factor analysis to organize

Q29: When psychoanalyzing children, Anna Freud believed<br>A) that

Q29: George and James are forming the GJ

Q31: Who pioneered the American trait theory?<br>A) Allport<br>B)

Q81: Performance,Inc.,a U.S.corporation,owns 100% of Krumb,Ltd.,a foreign corporation.Krumb

Q88: A number of court cases in the

Q117: José Corporation realized $900,000 taxable income