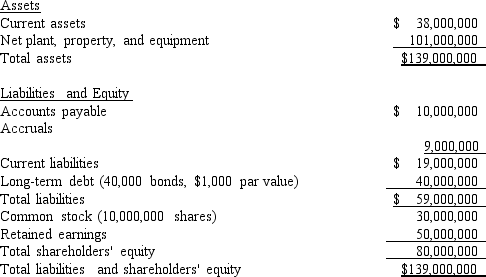

Exhibit 9.1

The Collins Group, a leading producer of custom automobile accessories, has hired you to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below.

The stock is currently selling for $15.25 per share, and its noncallable $1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%.

-Refer to Exhibit 9.1.What is the best estimate of the after-tax cost of debt?

Definitions:

Erotic Plasticity

The degree to which an individual's sex drive can be changed by social, cultural, and situational factors.

Late Teens

This term refers to the age period of individuals who are around 16 to 19 years old, nearing the transition from adolescence to adulthood.

Alcohol

A psychoactive substance known for its depressant effects on the central nervous system, found in beverages like beer, wine, and spirits.

Habituation

The process of becoming accustomed to a stimulus after repeated exposure, leading to a decrease in response.

Q1: Silvana Inc.projects the following data for

Q12: Which of the following statements is CORRECT?<br>A)

Q15: If a firm with a positive net

Q16: Changes in a firm's collection policy can

Q27: Stocks X and Y have the

Q29: The capital intensity ratio is the amount

Q42: A Eurodollar is a U.S.dollar deposited in

Q80: When estimating the cost of equity by

Q97: If markets are in equilibrium,which of the

Q119: One of the advantages of short-term debt