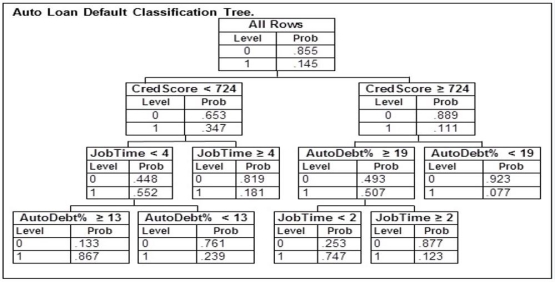

An automobile finance company analyzed a sample of recent automobile loans to try to determine key factors in identifying borrowers who would be likely to default on their auto loan. The response variable Default equals 1 if the borrower defaulted during the term of the loan and 0 otherwise. The predictor variable AutoDebt% was the ratio (expressed as a percent) of the required loan payments to the borrower's take-home income at the time of purchase. JobTime was the number of years the borrower had worked at their current job at the time of purchase. CredScore was the borrower's credit score at the time of purchase. Below is part of the classification tree the finance company derived from the data collected in the study. Assume they classify those with a default probability estimate of at least .5 as Defaulters.  Based on this classification tree, a member of the study sample who had a credit score of 819, been at their current job for 3 years, took out a loan with payments equaling 15% of their income, and did not default would be

Based on this classification tree, a member of the study sample who had a credit score of 819, been at their current job for 3 years, took out a loan with payments equaling 15% of their income, and did not default would be

Definitions:

Scheduled Interest Payment

This refers to the periodic interest payments that a borrower is obligated to make to a lender under the terms of a debt instrument.

Payment Default

Failure to meet the obligations of a credit agreement, such as not making the required payments on a loan or bond by the due date.

Technical Default

A situation where a borrower violates a term or condition of a loan agreement without causing financial harm to the lender.

Restricted Stock

A type of stock that is not fully transferable until certain conditions have been met, typically used as part of employee compensation packages.

Q12: Determine whether these two events are mutually

Q44: If the sampled population distribution is skewed

Q54: The mean and the median are the

Q66: In the upcoming election for governor, the

Q81: An automobile finance company analyzed a sample

Q93: Four employees who work as drive-through attendants

Q122: In a statistics class, 10 scores were

Q132: In any probability situation, either an event

Q137: Find z when the area between 0

Q149: Determine whether these two events are mutually