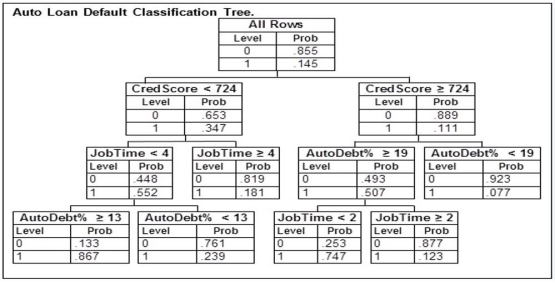

An automobile finance company analyzed a sample of recent automobile loans to try to determine key factors in identifying borrowers who would be likely to default on their auto loan. The response variable Default equals 1 if the borrower defaulted during the term of the loan and 0 otherwise. The predictor variable AutoDebt% was the ratio (expressed as a percent) of the required loan payments to the borrower's take-home income at the time of purchase. JobTime was the number of years the borrower had worked at their current job at the time of purchase. CredScore was the borrower's credit score at the time of purchase. Below is part of the classification tree the finance company derived from the data collected in the study. Assume they classify those with a default probability estimate of at least .5 as Defaulters.  A potential borrower with a credit score of 724 who has been at their current job for 3 years and has a monthly salary of $6,000 would like to apply for a loan. To be approved for the loan they would need to be classified as a non-Defaulter. Of the following monthly payments, which is the highest this loan could have to be approved for this potential borrower?

A potential borrower with a credit score of 724 who has been at their current job for 3 years and has a monthly salary of $6,000 would like to apply for a loan. To be approved for the loan they would need to be classified as a non-Defaulter. Of the following monthly payments, which is the highest this loan could have to be approved for this potential borrower?

Definitions:

Dissociative Amnesia

A condition characterized by memory loss that is caused by psychological stress or trauma rather than by physical damage to the brain.

Anterograde Amnesia

A condition that prevents an individual from forming new memories after the event that caused the amnesia, though memories from before the event remain intact.

Korsakoff's Syndrome

A chronic memory disorder caused by severe deficiency of thiamine (vitamin B1), most commonly associated with prolonged alcoholism.

Somatic Symptom Disorder

A mental disorder in which a person has significant focus on physical symptoms, such as pain, that causes major emotional distress and problems functioning.

Q3: Packages of sugar bags for Sweeter Sugar

Q26: Two characteristics, or assumptions, of the Poisson

Q31: A worldwide personal products manufacturer is working

Q36: By taking a systematic sample in which

Q66: Historical data for a local manufacturing company

Q87: Using Chebyshev's Theorem, find the interval that

Q104: The number of standard deviations that a

Q120: If p = .5 and n =

Q125: In a statistics class, 10 scores were

Q134: In the calculation of a mean for