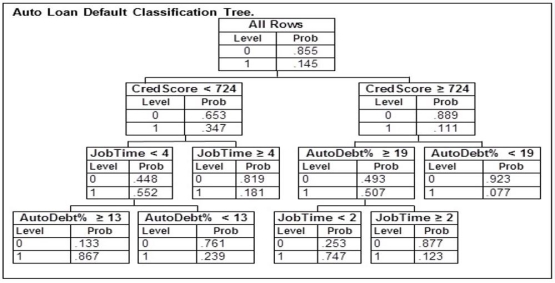

An automobile finance company analyzed a sample of recent automobile loans to try to determine key factors in identifying borrowers who would be likely to default on their auto loan. The response variable Default equals 1 if the borrower defaulted during the term of the loan and 0 otherwise. The predictor variable AutoDebt% was the ratio (expressed as a percent) of the required loan payments to the borrower's take-home income at the time of purchase. JobTime was the number of years the borrower had worked at their current job at the time of purchase. CredScore was the borrower's credit score at the time of purchase. Below is part of the classification tree the finance company derived from the data collected in the study. Assume they classify those with a default probability estimate of at least .5 as Defaulters.  Based on this classification tree, a member of the study sample who had a credit score of 802, been at their current job for 1 year, took out a loan with payments equaling 19% of their income, and defaulted would be

Based on this classification tree, a member of the study sample who had a credit score of 802, been at their current job for 1 year, took out a loan with payments equaling 19% of their income, and defaulted would be

Definitions:

Age

The length of time that a person or object has existed, often used to denote the life stage of an individual.

Intellectual Disability

A situation marked by considerable deficits in both cognitive capabilities and adaptive actions, including a spectrum of daily life social and practical proficiencies.

Adaptive Abilities

The capability of individuals or species to adjust or change in response to new or altered environmental conditions.

Profound

Having deep insight or understanding; extremely meaningful or significant.

Q18: The range of the measurement is the

Q27: Which of the following is a measure

Q43: An internet service provider (ISP) has randomly

Q44: _ and _ are used to describe

Q48: If events A and B are independent,

Q50: _ values of the standard deviation result

Q53: Suppose that the times required for a

Q72: The exponential probability distribution is based on

Q94: Which of the following would you find

Q102: While conducting experiments, a marine biologist selects