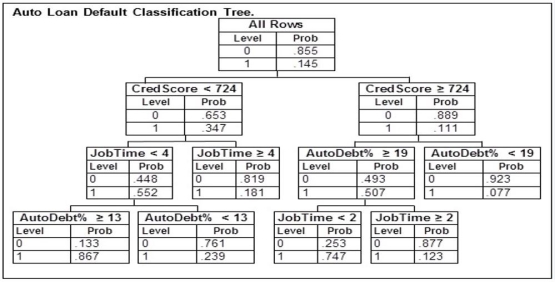

An automobile finance company analyzed a sample of recent automobile loans to try to determine key factors in identifying borrowers who would be likely to default on their auto loan. The response variable Default equals 1 if the borrower defaulted during the term of the loan and 0 otherwise. The predictor variable AutoDebt% was the ratio (expressed as a percent) of the required loan payments to the borrower's take-home income at the time of purchase. JobTime was the number of years the borrower had worked at their current job at the time of purchase. CredScore was the borrower's credit score at the time of purchase. Below is part of the classification tree the finance company derived from the data collected in the study. Assume they classify those with a default probability estimate of at least .5 as Defaulters.  A potential borrower with a credit score of 724 who has been at their current job for 6 years is applying for a loan with payments equaling 21% of their income. Based on this classification tree, the best estimate of the probability that this loan applicant would default would be

A potential borrower with a credit score of 724 who has been at their current job for 6 years is applying for a loan with payments equaling 21% of their income. Based on this classification tree, the best estimate of the probability that this loan applicant would default would be

Definitions:

Numerical Communications

The use of numbers and statistics to convey information or messages, especially in the context of data analysis and reporting.

American Medical Association

A professional group that represents the interests of physicians and healthcare professionals in the United States, advocating for public health and medical ethics.

Nursing Practice

The profession in which knowledge of the science of nursing, along with analytical skills, is utilized to provide care, promote health, and improve the quality of life for patients.

Accredited

Officially recognized or authorized by having met a set of standards, often through a formal evaluation process.

Q19: An example of manipulating a graphical display

Q20: In which of the following are the

Q52: The method of assigning probabilities when all

Q55: A car insurance company would like to

Q66: Four employees who work as drive-through attendants

Q83: A local electronics retailer recently conducted a

Q97: It is possible to create different interpretations

Q99: In a statistics class, 10 scores were

Q106: An apple juice producer buys all his

Q139: In a hearing test, randomly selected subjects