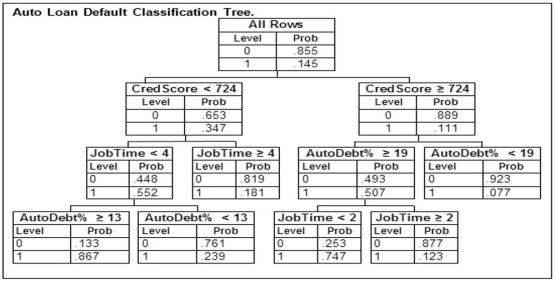

An automobile finance company analyzed a sample of recent automobile loans to try to determine key factors in identifying borrowers who would be likely to default on their auto loan. The response variable Default equals 1 if the borrower defaulted during the term of the loan and 0 otherwise. The predictor variable AutoDebt% was the ratio (expressed as a percent) of the required loan payments to the borrower's take-home income at the time of purchase. JobTime was the number of years the borrower had worked at their current job at the time of purchase. CredScore was the borrower's credit score at the time of purchase. Below is part of the classification tree the finance company derived from the data collected in the study. Assume they classify those with a default probability estimate of at least .5 as Defaulters.  Based on this classification tree, a member of the study sample who had a credit score of 724, been at their current job for 2 years, took out a loan with payments equaling 20% of their income, and did not default would be

Based on this classification tree, a member of the study sample who had a credit score of 724, been at their current job for 2 years, took out a loan with payments equaling 20% of their income, and did not default would be

Definitions:

Rent-Seeking Activity

Behavior by individuals or firms to increase their share of existing wealth without creating new wealth, often through lobbying for favorable regulations or policies.

Economic Efficiency

A state in which resources are allocated in the most beneficial way, maximizing the production of goods and services.

Government Program

Initiatives or plans implemented by the government to achieve specific social, economic, or political goals.

User Charges

are fees paid by the users of a public service or good, which are often used to fund the operation or maintenance of the service.

Q18: The range of the measurement is the

Q39: Values of the standard normal random variable

Q63: The mean of the binomial random variable

Q64: An MBA admissions officer wishes to predict

Q64: A report on high school graduation stated

Q85: An automobile finance company analyzed a sample

Q85: It is very common for a television

Q90: The random variable x has a uniform

Q97: The target population is the result of

Q148: At an oceanside nuclear power plant, seawater