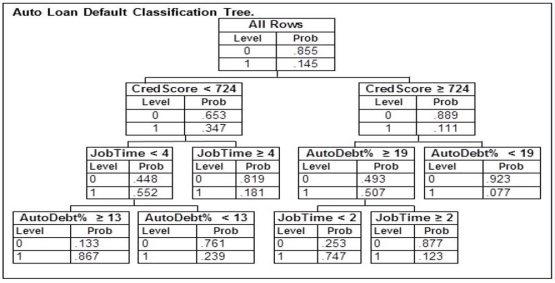

An automobile finance company analyzed a sample of recent automobile loans to try to determine key factors in identifying borrowers who would be likely to default on their auto loan. The response variable Default equals 1 if the borrower defaulted during the term of the loan and 0 otherwise. The predictor variable AutoDebt% was the ratio (expressed as a percent) of the required loan payments to the borrower's take-home income at the time of purchase. JobTime was the number of years the borrower had worked at their current job at the time of purchase. CredScore was the borrower's credit score at the time of purchase. Below is part of the classification tree the finance company derived from the data collected in the study. Assume they classify those with a default probability estimate of at least .5 as Defaulters.  A potential borrower who has been at their current job for 16 years would like to apply for a loan. To be approved for the loan they would need to be classified as a non-Defaulter. Of the following credit scores, which is the lowest this potential borrower could have to be approved for the loan?

A potential borrower who has been at their current job for 16 years would like to apply for a loan. To be approved for the loan they would need to be classified as a non-Defaulter. Of the following credit scores, which is the lowest this potential borrower could have to be approved for the loan?

Definitions:

Beginning Cash Balance

The amount of cash a company has at the start of a financial period.

Short-Term Loan

A loan scheduled to be repaid in less than a year, typically used for immediate or emergency financial needs.

Net Cash Flow

The difference between a company's cash inflows and outflows over a specific period of time.

Interest Payment

Interest Payment refers to the regular payment that a borrower makes to a lender for the use of borrowed money, typically part of the debt's service payments.

Q9: An MBA admissions officer wishes to predict

Q11: An internet service provider (ISP) has randomly

Q15: A company's Chief Operating Officer (COO) keeps

Q17: It is possible to use a random

Q22: A group has 12 men and 4

Q58: An individual collecting data directly through planned

Q67: In a manufacturing process, a machine produces

Q98: Consider a Poisson distribution with an average

Q103: Independently, a coin is tossed, a card

Q135: The weight of a product is normally