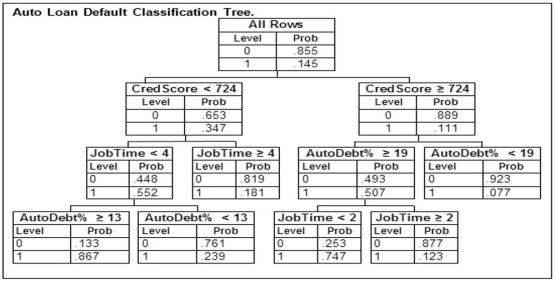

An automobile finance company analyzed a sample of recent automobile loans to try to determine key factors in identifying borrowers who would be likely to default on their auto loan. The response variable Default equals 1 if the borrower defaulted during the term of the loan and 0 otherwise. The predictor variable AutoDebt% was the ratio (expressed as a percent) of the required loan payments to the borrower's take-home income at the time of purchase. JobTime was the number of years the borrower had worked at their current job at the time of purchase. CredScore was the borrower's credit score at the time of purchase. Below is part of the classification tree the finance company derived from the data collected in the study. Assume they classify those with a default probability estimate of at least .5 as Defaulters.  Based on this classification tree, a member of the study sample who had a credit score of 724, been at their current job for 2 years, took out a loan with payments equaling 20% of their income, and did not default would be

Based on this classification tree, a member of the study sample who had a credit score of 724, been at their current job for 2 years, took out a loan with payments equaling 20% of their income, and did not default would be

Definitions:

Charles Willson Peale

An American painter, soldier, and naturalist known for his portraits of leading figures of the American Revolution and the early United States.

John Trumbull

An American artist known for his historical paintings, particularly those that capture scenes from the American Revolutionary War.

American Revolution

The period (1765-1783) during which the thirteen American colonies fought for and gained independence from British rule.

Hamilton's Concept

Refers to Alexander Hamilton's financial policies designed to stabilize the American economy, including the creation of the national bank and assumption of state debts by the federal government.

Q28: A normal distribution with mean equal to

Q33: For a binomial process, the probability of

Q36: Joe is considering pursuing an MBA degree.

Q38: The cashier service time at the local

Q53: The confusion matrix is not a good

Q61: Consider two population distributions labeled A and

Q71: According to a hospital administrator, historical records

Q73: A local electronics retailer recently conducted a

Q86: An unusually large or small observation separated

Q144: Two events are independent if the probability