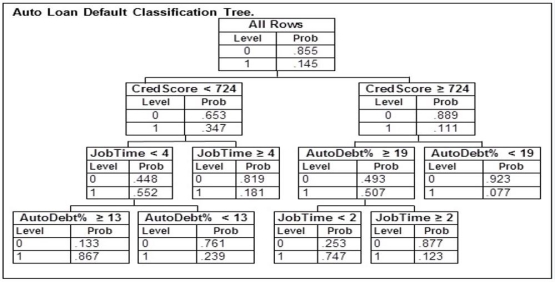

An automobile finance company analyzed a sample of recent automobile loans to try to determine key factors in identifying borrowers who would be likely to default on their auto loan. The response variable Default equals 1 if the borrower defaulted during the term of the loan and 0 otherwise. The predictor variable AutoDebt% was the ratio (expressed as a percent) of the required loan payments to the borrower's take-home income at the time of purchase. JobTime was the number of years the borrower had worked at their current job at the time of purchase. CredScore was the borrower's credit score at the time of purchase. Below is part of the classification tree the finance company derived from the data collected in the study. Assume they classify those with a default probability estimate of at least .5 as Defaulters.  Based on this classification tree, a member of the study sample who had a credit score of 819, been at their current job for 3 years, took out a loan with payments equaling 15% of their income, and did not default would be

Based on this classification tree, a member of the study sample who had a credit score of 819, been at their current job for 3 years, took out a loan with payments equaling 15% of their income, and did not default would be

Definitions:

Environmental Policies

Guidelines and regulations designed to manage human activities with the goal of preventing, reducing, or mitigating harmful effects on nature and the environment.

Career Development Policies

Practices and procedures that companies implement to support and guide employees' career growth and progression.

Compensation Policies

Are guidelines and frameworks that govern how employees are remunerated for their contributions to the organization.

Accessibility Policies

Guidelines and practices put in place by an organization or government to ensure that services, facilities, and information are accessible to people with disabilities.

Q10: The population mean is the average of

Q23: The cashier service time at the local

Q32: Container 1 has 8 items, 3 of

Q53: A large disaster cleaning company estimates that

Q61: According to data from the state blood

Q67: Which of the following graphs is for

Q76: A common practice in selecting a sample

Q94: The internal auditing staff of a local

Q120: A sample of 2,000 people yielded <img

Q141: The simultaneous occurrence of events A and