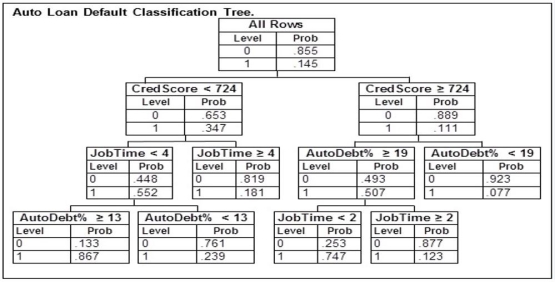

An automobile finance company analyzed a sample of recent automobile loans to try to determine key factors in identifying borrowers who would be likely to default on their auto loan. The response variable Default equals 1 if the borrower defaulted during the term of the loan and 0 otherwise. The predictor variable AutoDebt% was the ratio (expressed as a percent) of the required loan payments to the borrower's take-home income at the time of purchase. JobTime was the number of years the borrower had worked at their current job at the time of purchase. CredScore was the borrower's credit score at the time of purchase. Below is part of the classification tree the finance company derived from the data collected in the study. Assume they classify those with a default probability estimate of at least .5 as Defaulters.  A potential borrower with a credit score of 724 who has been at their current job for 6 years is applying for a loan with payments equaling 21% of their income. Based on this classification tree, the best estimate of the probability that this loan applicant would default would be

A potential borrower with a credit score of 724 who has been at their current job for 6 years is applying for a loan with payments equaling 21% of their income. Based on this classification tree, the best estimate of the probability that this loan applicant would default would be

Definitions:

Hydrophobic

Characteristic of molecules that repel water; substances that are not easily soluble in water.

Hydrophilic

A term describing molecules or substances that have an affinity for water, making them capable of dissolving in or being wetted by water.

Fatty Acid

A lipid that is an organic acid containing a long hydrocarbon chain, with no double bonds (saturated fatty acid), one double bond (monounsaturated fatty acid), or two or more double bonds (polyunsaturated fatty acid); components of triacylglycerols and phospholipids, as well as monoacylglycerols and diacylglycerols.

Ligand

A molecule that binds to a specific site in a receptor or other protein.

Q1: The _ of two events A and

Q17: A manager has just received the expense

Q37: The number of measurements falling within a

Q42: Two mutually exclusive events having positive probabilities

Q69: A _ displays the frequency of each

Q69: A cable television company has randomly selected

Q72: The exponential probability distribution is based on

Q87: The actual weight of hamburger patties is

Q126: What is the probability of rolling a

Q139: The Securities and Exchange Commission has determined