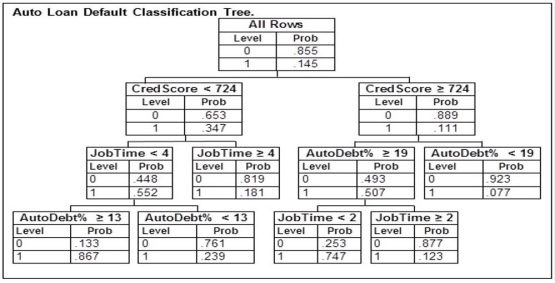

An automobile finance company analyzed a sample of recent automobile loans to try to determine key factors in identifying borrowers who would be likely to default on their auto loan. The response variable Default equals 1 if the borrower defaulted during the term of the loan and 0 otherwise. The predictor variable AutoDebt% was the ratio (expressed as a percent) of the required loan payments to the borrower's take-home income at the time of purchase. JobTime was the number of years the borrower had worked at their current job at the time of purchase. CredScore was the borrower's credit score at the time of purchase. Below is part of the classification tree the finance company derived from the data collected in the study. Assume they classify those with a default probability estimate of at least .5 as Defaulters.  A potential borrower with a credit score of 723 who has been at their current job for 7 years is applying for a loan with payments equaling 11% of their income. Based on this classification tree, the best estimate of the probability that this loan applicant would default would be ________.

A potential borrower with a credit score of 723 who has been at their current job for 7 years is applying for a loan with payments equaling 11% of their income. Based on this classification tree, the best estimate of the probability that this loan applicant would default would be ________.

Definitions:

Home Safety

Practices and precautions implemented in living areas to prevent accidents, injuries, and emergencies.

One-Level Living

A residential layout without stairs, facilitating easier movement for people with mobility issues.

Shopping Center

A complex or area that hosts multiple retail stores and commercial establishments where people can shop for various goods and services.

Safety Bars

Devices installed in bathrooms, hallways, or other areas to provide support and prevent falls.

Q1: A continuous probability distribution that has a

Q11: The number of defectives in 10 different

Q12: Determine whether these two events are mutually

Q29: When sample size is 11, find t<sub>.025</sub>.

Q52: An automobile finance company analyzed a sample

Q57: The manager of the local grocery store

Q72: If events A and B are mutually

Q73: A golf tournament organizer is attempting to

Q85: It is very common for a television

Q92: Suppose that the times required for a