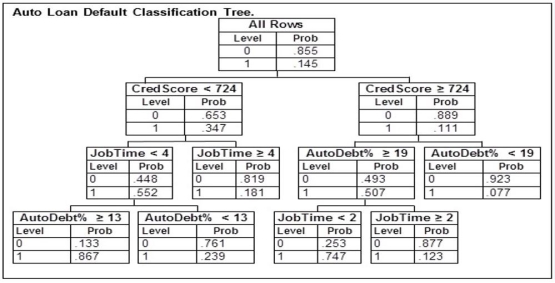

An automobile finance company analyzed a sample of recent automobile loans to try to determine key factors in identifying borrowers who would be likely to default on their auto loan. The response variable Default equals 1 if the borrower defaulted during the term of the loan and 0 otherwise. The predictor variable AutoDebt% was the ratio (expressed as a percent) of the required loan payments to the borrower's take-home income at the time of purchase. JobTime was the number of years the borrower had worked at their current job at the time of purchase. CredScore was the borrower's credit score at the time of purchase. Below is part of the classification tree the finance company derived from the data collected in the study. Assume they classify those with a default probability estimate of at least .5 as Defaulters.  A potential borrower who has just started their current job would like to apply for a loan with payments equaling 17% of their income. To be approved for the loan they would need to be classified as a non-Defaulter. Of the following credit scores, which is the lowest this potential borrower could have to be approved for the loan?

A potential borrower who has just started their current job would like to apply for a loan with payments equaling 17% of their income. To be approved for the loan they would need to be classified as a non-Defaulter. Of the following credit scores, which is the lowest this potential borrower could have to be approved for the loan?

Definitions:

Interacting

The process by which two or more individuals influence each other’s behavior through verbal or non-verbal communication.

Factor Analysis

A statistical procedure used to determine the number of dimensions in a data set.

Personality Tests

Standardized tools used to evaluate an individual's character traits, dispositions, and values to understand personality.

Hypothesis

A formal prediction about the relationship between two or more variables that is logically derived from a theory.

Q3: A standard normal distribution has a mean

Q15: During the past six months, 73.2 percent

Q18: A random sample of size 36 is

Q25: Recently an advertising company called 200 people

Q26: If we have a sample size of

Q89: At a college, 70 percent of the

Q95: Time series data are data collected at

Q103: The mean is one component of the

Q114: A set of final examination grades in

Q118: In a statistics class, 10 scores were