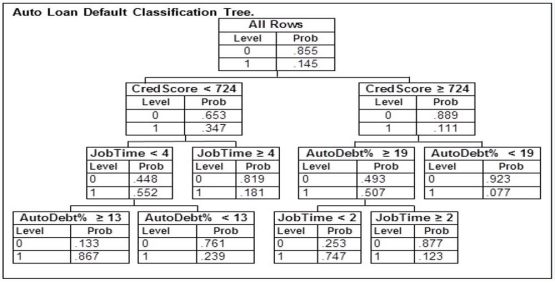

An automobile finance company analyzed a sample of recent automobile loans to try to determine key factors in identifying borrowers who would be likely to default on their auto loan. The response variable Default equals 1 if the borrower defaulted during the term of the loan and 0 otherwise. The predictor variable AutoDebt% was the ratio (expressed as a percent) of the required loan payments to the borrower's take-home income at the time of purchase. JobTime was the number of years the borrower had worked at their current job at the time of purchase. CredScore was the borrower's credit score at the time of purchase. Below is part of the classification tree the finance company derived from the data collected in the study. Assume they classify those with a default probability estimate of at least .5 as Defaulters.  A potential borrower with a credit score of 600 who has just started their current job with a monthly salary of $5,000 would like to apply for a loan. To be approved for the loan they would need to be classified as a non-Defaulter. Of the following monthly payments, which is the highest this loan could have to be approved for this potential borrower?

A potential borrower with a credit score of 600 who has just started their current job with a monthly salary of $5,000 would like to apply for a loan. To be approved for the loan they would need to be classified as a non-Defaulter. Of the following monthly payments, which is the highest this loan could have to be approved for this potential borrower?

Definitions:

Emancipation Proclamation

A historic executive order issued by President Abraham Lincoln in 1863, declaring the freedom of all enslaved people in Confederate states during the American Civil War.

Foreign Support

Assistance or backing provided by entities or governments from countries other than one's own.

Border States

The slave states that did not declare secession from the Union during the U.S. Civil War, including Delaware, Maryland, Kentucky, and Missouri, which were of strategic importance.

Immediate Emancipation

The instant freeing of slaves or serfs, with no delay or gradual process, often discussed in the context of historical movements to end slavery.

Q3: A company collected the ages from a

Q31: Judgment sampling occurs when a person who

Q33: _ consists of a set of concepts

Q60: Which of the following possible response variables

Q67: Because different trust levels may be appropriate

Q84: Employees of a local university have been

Q119: The average time an individual reads online

Q120: In a statistics class, 10 scores were

Q136: The average time an individual reads online

Q137: At a college, 70 percent of the