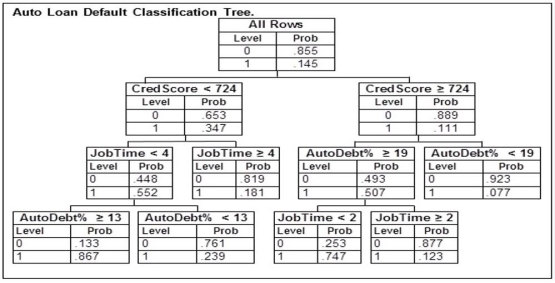

An automobile finance company analyzed a sample of recent automobile loans to try to determine key factors in identifying borrowers who would be likely to default on their auto loan. The response variable Default equals 1 if the borrower defaulted during the term of the loan and 0 otherwise. The predictor variable AutoDebt% was the ratio (expressed as a percent) of the required loan payments to the borrower's take-home income at the time of purchase. JobTime was the number of years the borrower had worked at their current job at the time of purchase. CredScore was the borrower's credit score at the time of purchase. Below is part of the classification tree the finance company derived from the data collected in the study. Assume they classify those with a default probability estimate of at least .5 as Defaulters.  A potential borrower with a credit score of 752 who just started their current job is applying for a loan with payments equaling 19% of their income. Based on this classification tree, the best estimate of the probability that this loan applicant would default would be

A potential borrower with a credit score of 752 who just started their current job is applying for a loan with payments equaling 19% of their income. Based on this classification tree, the best estimate of the probability that this loan applicant would default would be

Definitions:

Simple Sentence

A sentence structure that contains one subject and one predicate, conveying a complete thought or idea without subordinate clauses.

Single Subject

Focusing on one specific topic, discipline, or area of study in educational settings or research.

Single Predicate

In logic and grammar, a component of a sentence that tells something about the subject or expresses an action.

Complex Sentence

A sentence that contains an independent clause and at least one dependent clause, conveying more detailed or nuanced information.

Q5: The property of expected values says if

Q26: A computer manufacturing company has sent a

Q44: It is appropriate to use the Empirical

Q51: The diameter of small Nerf balls manufactured

Q54: Suppose you randomly select 3 DVDs from

Q56: Consider the following data on distances traveled

Q85: An automobile finance company analyzed a sample

Q126: Using the following probability distribution table of

Q129: A plant manager knows that the number

Q136: The number of ways to arrange x