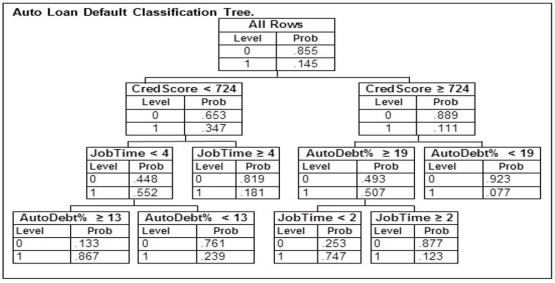

An automobile finance company analyzed a sample of recent automobile loans to try to determine key factors in identifying borrowers who would be likely to default on their auto loan. The response variable Default equals 1 if the borrower defaulted during the term of the loan and 0 otherwise. The predictor variable AutoDebt% was the ratio (expressed as a percent) of the required loan payments to the borrower's take-home income at the time of purchase. JobTime was the number of years the borrower had worked at their current job at the time of purchase. CredScore was the borrower's credit score at the time of purchase. Below is part of the classification tree the finance company derived from the data collected in the study. Assume they classify those with a default probability estimate of at least .5 as Defaulters.  A potential borrower with a credit score of 503 who has been at their current job for 4 years and has a monthly income of $4,700 would like to apply for a loan. To be approved for the loan they would need to be classified as a non-Defaulter. Of the following monthly payments, which is the highest this loan could have to be approved for this potential borrower?

A potential borrower with a credit score of 503 who has been at their current job for 4 years and has a monthly income of $4,700 would like to apply for a loan. To be approved for the loan they would need to be classified as a non-Defaulter. Of the following monthly payments, which is the highest this loan could have to be approved for this potential borrower?

Definitions:

Democratization

The process of making a political system more democratic, typically involving the transition from an authoritarian regime to a democratic one.

XYZ Affair

Affair in which French foreign minister Talleyrand’s three anonymous agents demanded payments to stop French plundering of American ships in 1797; refusal to pay the bribe was followed by two years of undeclared sea war with France (1798–1800).

Judicial Review

The power of courts to assess the constitutionality of legislative acts or governmental actions and to overrule those that are found unconstitutional.

Mob Rule

A situation in which control is taken away from duly elected authorities or established rules and instead is exercised by the masses or crowds, often leading to chaos and disorder.

Q5: Gauges feature a single measure showing variation

Q27: An automobile finance company analyzed a sample

Q33: If the sample size n is infinitely

Q42: If a population distribution is known to

Q44: New car owners were asked to evaluate

Q44: The number of sick days per month

Q45: It is very common for a television

Q106: The following is a partial relative frequency

Q111: 822 recently purchased books were randomly selected

Q133: Using Chebyshev's theorem, approximate the minimum proportion