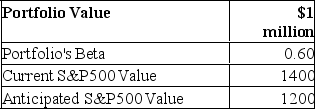

You are given the following information about a portfolio you are to manage.For the long term, you are bullish, but you think the market may fall over the next month.  How many contracts should you buy or sell to hedge your position? Allow fractions of contracts in your answer.

How many contracts should you buy or sell to hedge your position? Allow fractions of contracts in your answer.

Definitions:

Normally Distributed

A type of distribution in which the data's histogram has a bell-shaped curve, indicating that most values cluster around a central region, with fewer at the edges.

Standard Deviation

A statistical measure of the dispersion or spread of data points in a data set.

Tax Rebate

A refund on taxes paid, typically when the tax liability is less than the taxes paid.

Achievement Test

A test designed to assess a person's knowledge or proficiency in a particular area or subject.

Q1: "Trouble talk" is a social function of

Q1: The elasticity of a stock put option

Q19: Light Construction Machinery Company has an expected

Q20: In the Treynor-Black model,<br>A)portfolio weights are sensitive

Q32: Music Doctors Company has an expected ROE

Q37: Futures contracts _ traded on an organized

Q43: Suppose that the risk-free rates in the

Q54: A put option on a stock is

Q61: Suppose you purchase one WFM May 100

Q71: A preferred stock will pay a dividend