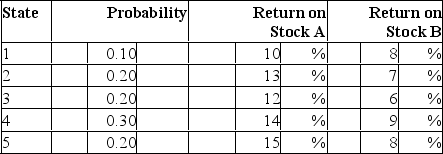

Consider the following probability distribution for stocks A and B:  If you invest 40% of your money in A and 60% in B, what would be your portfolio's expected rate of return and standard deviation?

If you invest 40% of your money in A and 60% in B, what would be your portfolio's expected rate of return and standard deviation?

Definitions:

Large Profits

Substantial earnings exceeding the costs of production and operation of a business.

Innovation

The process of creating new ideas, products, or methods, which can significantly change market dynamics or societal practices.

Annual Interest Rate

The percentage of the principal amount of a loan that is charged as interest to the borrower for one year.

Interest

The cost of borrowing money, typically expressed as an annual percentage of the loan amount.

Q2: If a market proxy portfolio consistently beats

Q3: A coupon bond that pays interest annually

Q18: Compared to investments in debt securities, equity

Q20: A coupon bond that pays interest annually

Q29: The smallest component of the fixed-income market

Q29: Given an optimal risky portfolio with expected

Q30: A coupon bond pays annual interest, has

Q33: You invest $100 in a risky asset

Q42: _ are balanced funds in which the

Q44: Financial assets permit all of the following