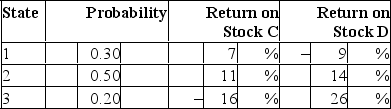

Consider the following probability distribution for stocks C and D:  If you invest 25% of your money in C and 75% in D, what would be your portfolio's expected rate of return and standard deviation?

If you invest 25% of your money in C and 75% in D, what would be your portfolio's expected rate of return and standard deviation?

Definitions:

Third-Country National

An individual who is working in a country that is neither their home country nor the country of the company's headquarters to which they are assigned.

International Organization

An organization that sets up one or a few facilities in one or a few foreign countries.

Production Costs

The total expenses incurred in the process of creating a product or service, including materials, labor, and overhead costs.

Distribution Costs

Expenses associated with delivering a product from the manufacturer to the end user, including transportation, storage, and handling.

Q1: Consider the single factor APT.Portfolios A and

Q4: You buy 300 shares of Qualitycorp for

Q4: If you believe in the reversal effect,

Q11: Security selection refers to<br>A)choosing which securities to

Q11: A Treasury bill with a par value

Q13: Treasury bills are commonly viewed as risk-free

Q22: You sold short 100 shares of common

Q31: Use the below information to answer the

Q34: A study by Mehra and Prescott (1985)

Q72: The bond indenture includes<br>A)the coupon rate of