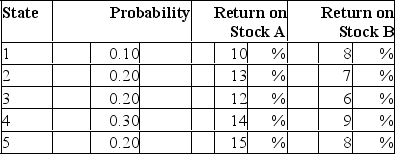

Consider the following probability distribution for stocks A and B:  The expected rates of return of stocks A and B are _____ and _____, respectively.

The expected rates of return of stocks A and B are _____ and _____, respectively.

Definitions:

Percentage Change

A mathematical calculation that represents the degree of change over time, expressed as a percent, indicating how much something has increased or decreased.

GDP Deflator

An apparatus for gauging the level of prices of all newly made, domestic final goods and services in an economic setting.

Percentage Change

A mathematical calculation that shows how much a quantity has increased or decreased as a proportion of its previous value, often expressed as a percentage.

National Income

The total value of all goods and services produced by a country's economy over a specific period, including income from abroad, and serving as a measure of economic health.

Q20: Historical records regarding return on stocks, Treasury

Q25: Investors can use publicly available financial data

Q30: If the index model is valid,

Q32: You invest $100 in a risky asset

Q40: The first major step in asset allocation

Q46: Suppose an investor is considering a corporate

Q47: Until 1999, the _ Act(s) prohibited banks

Q51: If the index model is valid,

Q61: Federally-sponsored agency debt<br>A)is legally insured by the

Q100: If a 7.25% coupon bond is trading