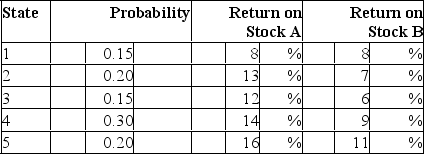

Consider the following probability distribution for stocks A and B:  If you invest 35% of your money in A and 65% in B, what would be your portfolio's expected rate of return and standard deviation?

If you invest 35% of your money in A and 65% in B, what would be your portfolio's expected rate of return and standard deviation?

Definitions:

Average Cost

Average Cost is a cost accounting method that calculates the cost of goods sold and ending inventory value by averaging the total cost of goods available for sale over the total units.

Subscription Sales

Income generated from selling access to a product or service over a period of time rather than as a single purchase.

Newsstand Sales

Revenue generated from selling publications, such as newspapers and magazines, directly to consumers through newsstands.

Adjusting Entry

An entry made in the accounting journals at the end of an accounting period to allocate income and expenditure to the period in which they actually occurred.

Q3: In 2016, _ was(were) the least significant

Q6: When a distribution is negatively skewed,<br>A)standard deviation

Q9: If the index model is valid,

Q12: Errors in information processing can lead investors

Q32: Advantage(s) of the APT is(are)<br>A)that the model

Q34: The type of municipal bond that is

Q48: Of the following types of ETFs, an

Q54: The security market line (SML) is<br>A)the line

Q64: You sell short 100 shares of Loser

Q66: In calculating the Standard and Poor's stock