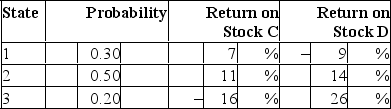

Consider the following probability distribution for stocks C and D:  If you invest 25% of your money in C and 75% in D, what would be your portfolio's expected rate of return and standard deviation?

If you invest 25% of your money in C and 75% in D, what would be your portfolio's expected rate of return and standard deviation?

Definitions:

Innate Ability

Innate ability refers to natural talents or capabilities that an individual is born with, as opposed to skills developed through learning or experience.

Redundancy

The state of being not or no longer needed or useful, often referring to repetitive or unnecessary information or the elimination of jobs in a workforce.

Suspense

A state of mental uncertainty, excitement, or anxiety regarding the outcome of certain events or actions.

Pauses

Short periods of silence strategically used in speech to enhance understanding, create emphasis, or allow the listener to process information.

Q9: If the index model is valid,

Q11: Security selection refers to<br>A)choosing which securities to

Q12: A Treasury bill with a par value

Q15: _ are financial assets.<br>A)Bonds<br>B)Machines<br>C)Stocks<br>D)Bonds and stocks

Q21: The index model has been estimated

Q25: You sold a futures contract on corn

Q29: When Maurice Kendall first examined stock price

Q29: The smallest component of the fixed-income market

Q31: A mutual fund had year-end assets of

Q98: A convertible bond has a par value