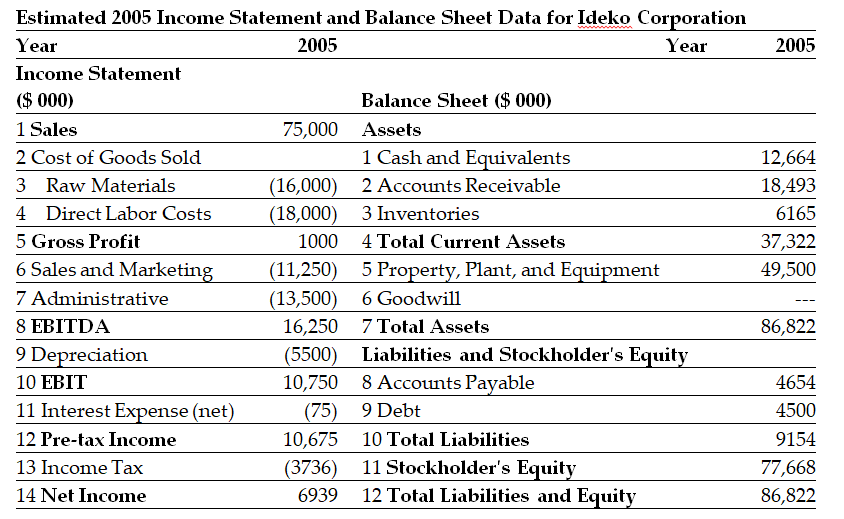

Use the tables for the question(s) below.

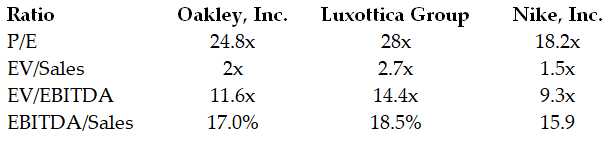

The following are financial ratios for three comparable companies:

-What range for the market value of equity for Ideko is implied by the range of EV/EBITDA multiples for the comparable firms if Ideko holds $6.5 million of cash in excess of its working capital needs?

Definitions:

Capital Budgeting Decisions

The process by which a business evaluates and selects long-term investments that are worth more than their cost, considering their potential to generate future profits.

Interest Rates

The cost of borrowing money or the return for investing money, typically expressed as a percentage of the principal amount per annum.

Investment Proposals

Proposals put forward for investing capital in projects or securities, aiming to generate returns.

Percentage of Sales Approach

A financial forecasting method that estimates changes in balance sheet or income statement accounts as a fixed percentage of sales.

Q1: The merger of two companies in the

Q1: In 2000,assuming an average dividend payout ratio

Q6: Consider the following equation: C = P

Q18: Galt's WACC is closest to:<br>A)6.0%.<br>B)9.6%.<br>C)11.1%.<br>D)10.7%.

Q24: Suppose you own 10% of the equity

Q28: If Luther acquires the new fleet of

Q29: Using the income statement above and the

Q48: The cost of _ is highest for

Q71: Assume that investors in Google pay a

Q72: Consider the following formula: rwacc = <img