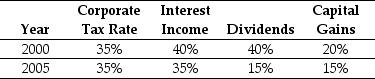

Use the table for the question(s) below.

Consider the following historical top federal tax rates in the United States:

Personal Tax Rates

-In 2000,assuming an average dividend payout ratio of 50%,the effective tax advantage for debt (t*) was closest to:

Definitions:

Pathogen

An organism, such as a virus, bacterium, prion, or fungus, that can cause disease in its host.

Cycle Of Infection

The process by which infectious agents multiply and spread from a source to a susceptible host, leading to disease transmission.

Method

A systematic way of doing something, often involving a detailed series of steps or procedures.

Pathogens

Microorganisms that cause disease in humans and other living hosts.

Q21: Which of the following statements is FALSE?<br>A)When

Q33: If the risk-free rate is 3% and

Q33: Assuming that the risk-free rate is 4%

Q38: A(n)_ may occur if a major shareholder

Q58: Wyatt Oil has a bond issue outstanding

Q69: The value of Luther without leverage is

Q71: Portfolio "B":<br>A)is less risky than the market

Q96: Nielson's equity cost of capital is closest

Q118: Which of the following is NOT an

Q130: The weight on Ball Corporation in your