Use the information for the question(s)below.

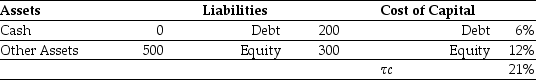

Omicron Industries' Market Value Balance Sheet ($ Millions)

and Cost of Capital  Omicron Industries' New Project Free Cash Flows (Millions)

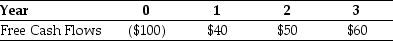

Omicron Industries' New Project Free Cash Flows (Millions)  Assume that this new project is of average risk for Omicron and that the firm wants to hold constant its debt to equity ratio.

Assume that this new project is of average risk for Omicron and that the firm wants to hold constant its debt to equity ratio.

-Calculate the present value of the interest tax shield provided by Omicron's new project.

Definitions:

Municipal Bonds

Municipal bonds are debt securities issued by states, cities, counties, and other governmental entities to fund day-to-day obligations and to finance capital projects such as building schools, highways, or sewer systems.

Tax Treatment

The way in which a particular financial transaction or investment is taxed by government policy, affecting incentives and behaviors.

Financial Intermediaries

Financial institutions through which savers can indirectly provide funds to borrowers

Financial Institutions

Organizations that provide financial services, including banks, insurance companies, and investment firms.

Q7: A credit default swap is essentially a:<br>A)put

Q15: Nielson's EPS if they choose not to

Q21: The free cash flow to the firm

Q24: The Black-Scholes value of a one-year call

Q30: IF FBNA increases leverage so that its

Q43: If the risk-free rate of interest is

Q49: Suppose that to raise the funds for

Q54: Assuming Luther issues a 5:2 stock split,then

Q93: Which of the following statements is FALSE?<br>A)If

Q94: Considering the fact that Luther's Cash is