Use the information for the question(s) below.

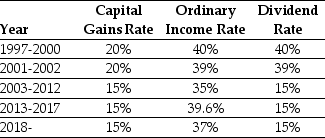

Consider the following tax rates:  *The current tax rates are set to expire after 2025 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 37% for the highest bracket) ;the same is true for dividends if the assets are held for less than 61 days.

*The current tax rates are set to expire after 2025 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 37% for the highest bracket) ;the same is true for dividends if the assets are held for less than 61 days.

-The effective dividend tax rate for a one-year individual investor in 1999 was closest to:

Definitions:

Guidelines

A set of recommendations or principles provided to direct actions or decisions in specific situations or practices.

Clinical Psychologists

Professionals specialized in diagnosing and treating mental, emotional, and behavioral disorders through psychological techniques and assessments.

Psychiatrists

Medical doctors specializing in the diagnosis, treatment, and prevention of mental illnesses and disorders.

Mental Disorders

A wide range of conditions that affect mood, thinking, and behavior, often leading to distress or impairment in daily functioning.

Q1: You pay $3.25 for a call option

Q2: Packaging a portfolio of financial securities and

Q5: When the value of one project depends

Q14: Using risk-neutral probabilities,the calculated price of a

Q17: Assume that you are an investor with

Q33: You are long both a put option

Q35: Consider the following equation: C = S

Q43: An option strategy in which you hold

Q64: The WACC for this project is closest

Q69: Assume that in addition to 1.25 billion