Use the information for the question(s) below.

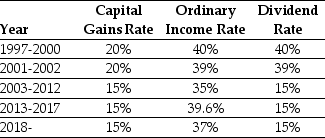

Consider the following tax rates:  *The current tax rates are set to expire after 2025 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 37% for the highest bracket) ;the same is true for dividends if the assets are held for less than 61 days.

*The current tax rates are set to expire after 2025 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 37% for the highest bracket) ;the same is true for dividends if the assets are held for less than 61 days.

-The effective dividend tax rate for a pension fund in 2006 was closest to:

Definitions:

William James

A pioneering American philosopher and psychologist, known for his foundational contributions to functionalism and pragmatism in psychology.

Robert Zajonc

A psychologist known for his work on social facilitation, the mere exposure effect, and other social and cognitive processes.

Emotional Reactions

The responses, often quick and automatic, of the emotional system to external or internal events.

Interpretation

The act of explaining the meaning of something or presenting one's understanding of a text, event, or situation.

Q14: The amount that Wyatt Oil pays as

Q19: In January 2010,the U.S.Treasury issued a $1000

Q28: Assume you want to buy one option

Q38: What is the failure cost index of

Q41: Which of the following statements regarding firm

Q42: The unlevered value of Luther's product line

Q43: What is the Yield to Call (YTC)on

Q64: The WACC for this project is closest

Q71: Portfolio "B":<br>A)is less risky than the market

Q106: Suppose that the managers at Rearden Metal