Use the following information to answer the question(s) below.

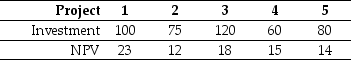

Nielson Motors has a debt-equity ratio of 1.8,an equity beta of 1.6,and a debt beta of 0.20.It is currently evaluating the following projects,none of which would change Nielson's volatility.  (All amounts are in $millions. )

(All amounts are in $millions. )

-Nielson Motors should accept those projects with profitability indices greater than:

Definitions:

Penetration Pricing

A strategy where a product is priced lower than its competitors or market average to gain market share rapidly at the expense of short-term profitability.

Sales Volume

The total number of units sold within a specified timeframe.

Unit Profits

The profit earned on each unit of product sold, calculated by subtracting the cost to produce and distribute a unit from its sale price.

Material Charge Formula

Typically refers to the calculation used to determine the cost of raw materials used in production or service delivery.

Q14: The Grant Corporation is considering permanently adding

Q21: Assume that you are an investor with

Q25: If Flagstaff currently maintains a .5 debt

Q31: As the seller of an option,you are

Q35: The effective dividend tax rate for a

Q55: What is a market value balance sheet

Q69: Assume that five years have passed since

Q79: The present value of KD's interest tax

Q79: Which of the following questions is FALSE?<br>A)Sometimes

Q90: Because debtor-in-possession (DIP)financing is senior to all