Use the following information to answer the question(s) below.

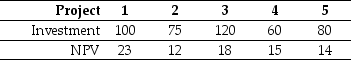

Nielson Motors has a debt-equity ratio of 1.8,an equity beta of 1.6,and a debt beta of 0.20.It is currently evaluating the following projects,none of which would change Nielson's volatility.  (All amounts are in $millions. )

(All amounts are in $millions. )

-The total debt overhang associated with accepting project 1 is closest to:

Definitions:

Utility Function

A mathematical representation in economics that describes how different goods or bundles of goods satisfy a consumer's needs and preferences.

Budget Constraint

An economic model representing all the combinations of goods and services a consumer can afford, given their income and the prices of goods.

Income

The financial gain or money received by an individual or household from various sources like work, investments, or transfers, over a period of time.

Apples

A popular fruit known for its variety and nutritional value often used in culinary dishes and beverages.

Q6: Taggart Transcontinental has a value of $500

Q6: Which of the following statements is FALSE?<br>A)The

Q15: If investors have relative wealth concerns,they care

Q18: Which of the following statements is FALSE?<br>A)The

Q19: Which of the following stocks represent selling

Q19: One method of repurchasing shares is the

Q24: Which of the following statements is FALSE?<br>A)In

Q43: An option strategy in which you hold

Q61: Which of the following statements is FALSE?<br>A)Many

Q85: The Market's average historical excess return is