Use the information for the question(s)below.

KD Industries has 30 million shares outstanding with a market price of $20 per share and no debt.KD has had consistently stable earnings,and pays a 35% tax rate.Management plans to borrow $200 million on a permanent basis through a leveraged recapitalization in which they would use the borrowed funds to repurchase outstanding shares.

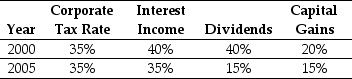

-Assume the following tax schedule:

Personal Tax Rates  Considering the effect of personal taxes,calculate the PV of the interest tax shield provided by KD's recapitalization in 2005.

Considering the effect of personal taxes,calculate the PV of the interest tax shield provided by KD's recapitalization in 2005.

Definitions:

NFIB Study

Research or reports produced by the National Federation of Independent Business, focusing on issues affecting small and medium-sized businesses.

Energy Prices

The cost assigned to energy sources, including electricity, natural gas, oil, and renewables, which fluctuate based on demand, supply, geopolitical dynamics, and environmental policies.

Health Insurance

A type of insurance coverage that pays for medical and surgical expenses incurred by the insured.

Governmental Paperwork

Documents required by government agencies that businesses need to fill out and submit for regulatory, tax, or legal purposes.

Q5: Portfolio "A":<br>A)has a relatively lower expected return

Q11: Which of the following statements is FALSE?<br>A)A

Q27: Assume that you own 4000 shares of

Q58: Which of the following statements is FALSE?<br>A)If

Q76: Which of the following statements is FALSE?<br>A)The

Q81: In which years were dividends NOT tax

Q89: Assume that Omicron uses the entire $50

Q96: Assuming your cost of capital is 6

Q98: The Sharpe ratio for the market portfolio

Q117: Consider a portfolio consisting of only Microsoft