Use the following information to answer the question(s) below.

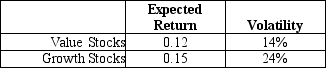

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk-free rate is 3.5%.

The risk-free rate is 3.5%.

-The Sharpe ratio for the market portfolio (which is a 50-50 combination of the value and growth portfolios) is closest to:

Definitions:

White Settlers

Individuals of European descent who settled in territories outside of Europe, often involving colonization and displacement of indigenous populations.

Internal Colonialism

A concept referring to the uneven and exploitative economic and political relationships within a country, often between dominant and marginalized groups.

Cultural Imperialism

The practice of promoting and imposing a culture, usually that of a more powerful nation, over a less powerful society.

Racism

Bias, injustice, or hostility toward individuals of a distinct race, stemming from the conviction that one's own race surpasses others.

Q26: The interest rate tax shield for Kroger

Q61: Which of the following statements is FALSE?<br>A)Many

Q63: The overall value of Wyatt Oil (in

Q64: Using just the return data for 2009,your

Q64: Assume that you purchased J.P.Morgan Chase stock

Q68: If Flagstaff currently maintains a .5 debt

Q73: If the expected return on the market

Q77: Assume that the corporate tax rate is

Q95: You expect KT Industries (KTI)will have earnings

Q96: Suppose over the next year Ball has