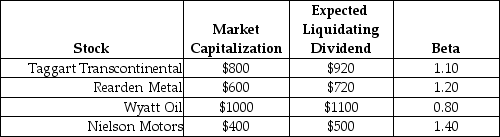

Use the following information to answer the question(s) below.  All amounts are in millions.

All amounts are in millions.

-If the risk-free rate is 3% and the market risk premium is 5%,then the CAPM's predicted expected return for Wyatt Oil is closest to:

Definitions:

Touch Screen

A display screen that detects and responds to touch gestures, allowing users to interact directly with what is displayed.

Double-tap

An input gesture involving two quick touches on a touchscreen interface, often used to zoom in or select options.

Right-dragging

The action of clicking and holding the right mouse button while moving the mouse, used in specific software contexts for advanced functions.

Shortcut Menu

A context-sensitive menu that appears when a user right-clicks within an application, providing quick access to common tasks.

Q3: Assume that Omicron uses the entire $50

Q13: If Flagstaff maintains a debt to equity

Q18: Which of the following statements is FALSE?<br>A)Given

Q48: Rearden's expected capital gains yield is closest

Q73: Rearden's expected dividend yield is closest to:<br>A)3.40%.<br>B)3.65%.<br>C)4.00%.<br>D)4.20%.

Q73: If the expected return on the market

Q80: What alternative investment has the highest possible

Q93: Which of the following statements is FALSE?<br>A)If

Q95: Which of the following statements is FALSE?<br>A)A

Q97: Assume that investors in Google pay a