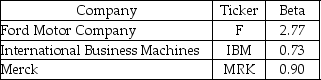

Use the following information to answer the question(s) below.

-If the expected return on the market is 11% and the expected return of investing in Merck is 10.35%,then the risk-free rate must be:

Definitions:

Boxplots

Graphic representations of the distribution of data indicating the median, quartiles, and outliers.

Case Prices

The cost or price associated with a specific quantity or lot of goods, often used in wholesale or bulk purchasing scenarios.

IQR

Interquartile Range, a measure of variability that indicates the spread between the first and third quartiles of a dataset.

Weights

objects used for measuring mass or for exercise and bodybuilding.

Q1: Which of the following formulas is INCORRECT?<br>A)Variance

Q2: Which of the following statements is FALSE?<br>A)The

Q24: The ei in the regression:<br>A)measures the market

Q31: Which of the following statements is FALSE?<br>A)A

Q51: The market capitalization of d'Anconia Copper after

Q51: Assuming that Luther's bonds receive a AAA

Q68: Which of the following statements is FALSE?<br>A)A

Q76: Which of the following statements regarding portfolio

Q84: Which of the following statements is FALSE?<br>A)Because

Q92: Which of the following statements is FALSE?<br>A)There