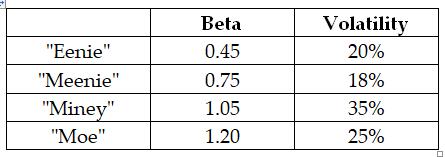

Use the following information to answer the question(s) below

Assume that the risk-free rate of interest is 3% and you estimate the market's expected return to be 9%.

-Which firm has the most total risk?

Definitions:

Perceived Value

The evaluation by individuals of the worth or desirability of a product, service, or experience based on their personal beliefs and experiences.

Demonstrating Real Value

The act of showing the tangible benefits and effectiveness of something, often in a business or service context.

Human Capital

Represents the collective skills, knowledge, or other intangible assets of individuals that can be used to create economic value for the individuals, their employers, or their community.

Aggregate

Aggregate refers to a total or combined amount or sum, often used in the context of data analysis to describe comprehensive totals across different categories.

Q6: Which of the following equations is INCORRECT?<br>A)P0

Q19: Suppose that to raise the funds for

Q24: Which of the following statements is FALSE?<br>A)To

Q31: The equity cost of capital for "Miney"

Q44: In an agency problem known as debt

Q53: FBNA's EBIT is closest to:<br>A)$33 million.<br>B)$40 million.<br>C)$45

Q66: The overall asset beta for Wyatt Oil

Q68: Suppose that MI has zero-coupon debt with

Q77: Which pharmaceutical company faces less risk?

Q125: Which of the following statements is FALSE?<br>A)A