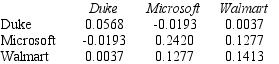

Use the table for the question(s)below.

Consider the following covariances between securities:

-What is the variance on a portfolio that has $2000 invested in Duke Energy,$3000 invested in Microsoft,and $5000 invested in Walmart stock?

Definitions:

Machines

Mechanical or electronic devices that perform various tasks when supplied with input or energy.

Provides Feedback

Refers to the process of giving constructive information or criticism to individuals regarding their performance or behavior.

Capacity Plan

Identifying the necessary production capabilities of an enterprise to fulfill varying product demands.

Production Plan

An outline of what a company plans to produce, in what quantities, and when, to meet anticipated demand.

Q9: Suppose you plan to hold Von Bora

Q10: Trucks R' Us (TRUS)has a market capitalization

Q11: Wyatt's current stock price is closest to:<br>A)$51.23.<br>B)$54.00.<br>C)$49.11.<br>D)$61.38.

Q12: Equity in a firm with debt is

Q19: If Nielson Motors invests in only those

Q20: The term <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7031/.jpg" alt="The term

Q45: Assume that MM's perfect capital market conditions

Q46: Which of the following is NOT an

Q66: Assuming perfect capital markets,the share price for

Q68: What is the NPV of the Epiphany's