Use the following information to answer the question(s) below.

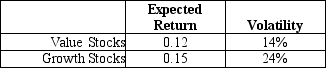

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk-free rate is 3.5%.

The risk-free rate is 3.5%.

-The Sharpe ratio for the market portfolio (which is a 50-50 combination of the value and growth portfolios) is closest to:

Definitions:

Arteries

Blood vessels that carry oxygenated blood away from the heart to the body's tissues, except for the pulmonary arteries, which carry deoxygenated blood to the lungs.

Veins

Blood vessels that carry blood towards the heart, typically carrying deoxygenated blood, except for the pulmonary and umbilical veins.

Sympathetic Nerve Fibers

Part of the autonomic nervous system that prepares the body for stress-related activities.

Tunica Media

The middle layer of the wall of a blood vessel or hollow organ, composed mostly of smooth muscle and elastic fibers, responsible for regulating the diameter of the vessel.

Q28: One of the IRRs for Rearden's mining

Q32: The income that would be available to

Q33: If the risk-free rate is 3% and

Q41: Assuming that Casa Grande Farms depreciates these

Q43: If its managers increase the risk of

Q61: Which of the following statements is FALSE?<br>A)Once

Q62: Suppose over the next year Ball Corporation

Q68: The decision you should take regarding this

Q99: The idea that claims in one's self-interest

Q105: The Volatility on Stock Y's returns is