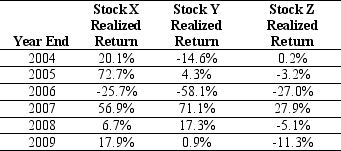

Use the table for the question(s)below.

Consider the following returns:

-Calculate the correlation between Stock Y's and Stock Z's returns .

Definitions:

Debt Ratio

Debt ratio is a financial ratio that measures the extent of a company's leverage by comparing its total debt to its total assets.

Total Liabilities

The combined amount of all financial obligations a company owes to external parties, recorded on the balance sheet.

Total Assets

The sum of all assets owned by a company, including current and non-current assets, as reported on the balance sheet.

Revenues

The total amount of income generated by the sale of goods or services related to a company’s primary operations.

Q6: Which of the following statements is FALSE?<br>A)The

Q27: The cost of capital for a project

Q29: The expected alpha for Taggart Transcontinental is

Q61: Which of the following statements is FALSE?<br>A)The

Q65: Which of the following statements is FALSE?<br>A)If

Q77: Consider the following equation: E + D

Q92: What is the beta for a type

Q96: If CCM has $150 million of debt

Q97: Which of the following statements is FALSE?<br>A)Firms

Q112: Assuming that Tom wants to maintain the