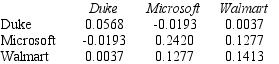

Use the table for the question(s)below.

Consider the following covariances between securities:

-What is the variance on a portfolio that has $3000 invested in Duke Energy,$4000 invested in Microsoft,and $3000 invested in Walmart stock?

Definitions:

Cash Operating

Refers to the activities that involve the cash inflows and outflows from a company's primary business operations.

Salvage Value

The anticipated amount an asset is expected to yield when it is sold after its lifespan has concluded.

Depreciation

The process of allocating the cost of a tangible asset over its useful life, reflecting the decrease in value over time.

Useful Life

The estimated time period that an asset is expected to be usable for its intended purpose, affecting its depreciation or amortization schedules.

Q13: If a project has a higher proportion

Q31: Do expected returns for individual stocks increase

Q31: Which of the following statements is FALSE?<br>A)A

Q53: Suppose an investment is equally likely to

Q55: What is a market value balance sheet

Q58: The difference between scenario analysis and sensitivity

Q63: The overall value of Wyatt Oil (in

Q66: The alpha for Bernard is closest to:<br>A)+5%.<br>B)-2%.<br>C)-3%.<br>D)+2%.

Q67: Which firm has the most total risk?<br>A)Eenie<br>B)Meenie<br>C)Miney<br>D)Moe

Q109: A type of agency problem that results