Use the following information to answer the question(s) below.

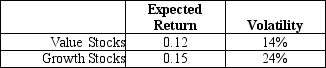

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk-free rate is 3.5%.

The risk-free rate is 3.5%.

-The expected return on the market portfolio (which is a 50-50 combination of the value and growth portfolios) is closest to:

Definitions:

Adventitia/Serosa

The adventitia or serosa is the outermost layer of an organ in the abdominal cavity, consisting of connective tissue covered by mesothelium.

Periodontal Ligament

A group of specialized connective tissue fibers that attach a tooth to the surrounding alveolar bone, playing a crucial role in the shock absorption during chewing.

Root Canal

A dental procedure to remove infected material and relieve pain from the soft core (dental pulp) of a tooth.

Dentin

A hard, dense, bony tissue forming the bulk of a tooth beneath the enamel.

Q1: The amount that Ford Motor Company will

Q19: The volatility of your investment is closest

Q29: The expected return on a security with

Q30: The Sharpe Ratio for the market portfolio

Q46: The Volatility on Stock X's returns is

Q50: The incremental EBIT for the Shepard Industries

Q51: The term <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7031/.jpg" alt="The term

Q62: Assume that your capital is constrained,so that

Q78: Assume that Kinston's new machine will be

Q79: What is a sunk cost? Should it