Use the following information to answer the question(s) below.

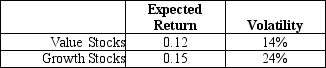

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk-free rate is 3.5%.

The risk-free rate is 3.5%.

-The volatility on the market portfolio (which is a 50-50 combination of the value and growth portfolios) is closest to:

Definitions:

Sustainable Development

Progress which satisfies current requirements without hindering future generations from fulfilling their necessities.

Human Population Growth

The increase in the number of individuals in a human population, often discussed in terms of its impact on the environment and resources.

Ecological Services

The benefits humans freely gain from the natural environment and properly functioning ecosystems, such as clean water, pollination, and disease control.

Frederick Taylor

Frederick Winslow Taylor was an American mechanical engineer who sought to improve industrial efficiency and is known as the father of scientific management.

Q13: What is the variance on a portfolio

Q20: Assume that investors hold Google stock in

Q32: Which of the following equations would NOT

Q51: JRN Enterprises just announced that it plans

Q57: Nielson Motors plans to issue 10-year bonds

Q60: Calculate the covariance between Stock Y's and

Q63: The price today of a 3-year default-free

Q64: Which of the following statements is FALSE?<br>A)When

Q70: Assume that capital markets are perfect except

Q98: Which of the following statements is FALSE?<br>A)If