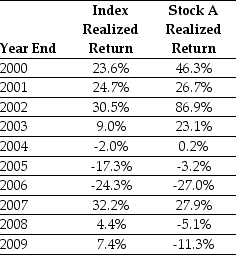

Use the table for the question(s) below.

Consider the following realized annual returns:

-The geometric average annual return on the Index from 2000 to 2009 is closest to:

Definitions:

Arteries

Blood vessels that carry oxygen-rich blood away from the heart to various parts of the body.

Elasticity

The ability of an object or material to resume its normal shape after being stretched or compressed, often referring to skin or other tissues in the human body.

Stroke

A medical condition that occurs when the blood supply to part of the brain is interrupted or reduced, causing brain cells to die.

Hypertension

A condition characterized by consistently elevated blood pressure levels above normal ranges.

Q1: What is the Beta for a type

Q21: Assume that you have $100,000 to invest

Q33: Which of the following statements is FALSE?<br>A)To

Q38: The variance on a portfolio that is

Q48: KAHR Incorporated will have EBIT this coming

Q62: Suppose you plan to hold Von Bora

Q69: Which of the following statements is FALSE?<br>A)The

Q74: Assuming that Defenestration's dividend payout rate and

Q78: Which of the following statements is FALSE?<br>A)Short-term

Q96: Suppose over the next year Ball has