Use the table for the question(s) below.

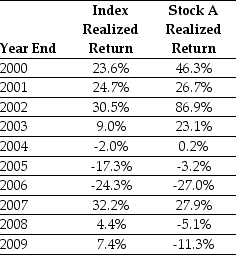

Consider the following realized annual returns:

-The average annual return on Stock A from 2000 to 2009 is closest to:

Definitions:

Totalitarian

A political system in which the state holds total authority over society and seeks to control all aspects of public and private life.

Propaganda

Information, especially of a biased or misleading nature, used to promote a political cause or point of view.

Terror Tactics

Methods used to instill fear and intimidation for political purposes, often involving violence or the threat of violence.

Military

Refers to the armed forces of a country, responsible for defending its borders and national interests.

Q4: Which of the following statements is FALSE?<br>A)Depreciation

Q25: Which of the following statements is FALSE?<br>A)When

Q29: The expected alpha for Taggart Transcontinental is

Q40: Suppose a five-year bond with a 7%

Q53: You are in the process of purchasing

Q59: Suppose that to raise the funds for

Q78: Wyatt Oil is contemplating issuing a 20-year

Q79: If you want to value a firm

Q84: Galt Industries has 125 million shares outstanding

Q90: Which of the following statements is FALSE?<br>A)Zero-coupon