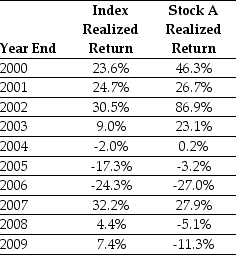

Use the table for the question(s) below.

Consider the following realized annual returns:

-Suppose that you want to use the 10-year historical average return on Stock A to forecast the expected future return on Stock A.The standard error of your estimate of the expected return is closest to:

Definitions:

Sexual Stereotyping

The process of assigning overly simplistic and generalized beliefs or roles to individuals based on their sexual orientation or gender.

Discrimination

Unfair treatment of individuals or groups based on characteristics such as race, gender, age, or sexual orientation.

Ethnocentrism

The belief in the inherent superiority of one's own ethnic group or culture, often accompanied by prejudice towards other groups.

Ethnicity

A social group that shares a common and distinctive culture, religion, language, or the like.

Q3: Assume that you purchased General Electric Company

Q19: What is the standard deviation of Big

Q28: Assuming that this bond trades for $1035.44,then

Q29: The expected alpha for Taggart Transcontinental is

Q43: Which of the following formulas is INCORRECT?<br>A)Invoice

Q44: The Sharpe Ratio for Wyatt Oil is

Q53: Forward interest rates:<br>A)accurately predict future spot rates

Q71: Plot the zero-coupon yield curve (for the

Q76: Your firm is planning to invest in

Q127: Which of the following statements is FALSE?<br>A)The