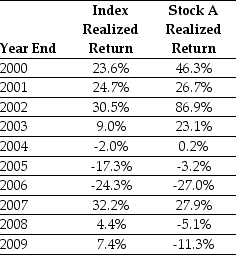

Use the table for the question(s) below.

Consider the following realized annual returns:

-The geometric average annual return on Stock A from 2000 to 2009 is closest to:

Definitions:

Networking

The building of relationships and sharing of information with colleagues who can help managers achieve the items on their agendas.

Participative Corporate Culture

A corporate environment where employees at all levels are encouraged to share their ideas and participate in decision making processes.

Q4: The alpha for the informed investors is

Q9: Which of the following statements is FALSE?<br>A)The

Q13: Interest on James Taggart's credit card balances

Q33: You are considering adding a microbrewery on

Q45: Which of the following statements is FALSE?<br>A)We

Q50: Which of the following statements is FALSE?<br>A)Since

Q53: A stock's alpha is defined as the

Q71: Portfolio "B":<br>A)is less risky than the market

Q76: Which of the following statements is FALSE?<br>A)When

Q87: Suppose that you want to use the