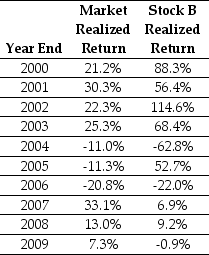

Use the table for the question(s)below.

Consider the following realized annual returns:

-Suppose that you want to use the 10-year historical average return on Stock B to forecast the expected future return on Stock B.Calculate the 95% confidence interval for your estimate of the expected return.

Definitions:

Sales on Account

Transactions where goods or services are sold and payment is deferred, resulting in the creation of accounts receivable for the seller.

Sales on Account

Transactions where goods or services are sold and payment is deferred, leading to the creation of accounts receivable on the balance sheet.

Merchandise

Goods that are purchased, stored, and sold by a business in its regular operations, often referred to as inventory.

Cash Collections

The process of receiving payment from customers for goods or services provided, impacting the company's cash flow positively.

Q5: The value of the oil exploration division

Q7: The term <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7031/.jpg" alt="The term

Q12: Which of the following statements is FALSE?<br>A)As

Q16: Which of the following statements is FALSE?<br>A)The

Q19: The price today of a three-year default-free

Q34: Which of the following statements is FALSE?<br>A)Nonzero

Q51: The value of the gas and convenience

Q52: The price of a five-year,zero-coupon,default-free security with

Q71: Assume that investors in Google pay a

Q102: Suppose that Gold Digger's beta is -0.8.If