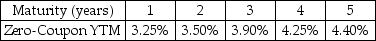

Use the following information to answer the question(s) below.

-The price today of a three-year default-free security with a face value of $1000 and an annual coupon rate of 4% is closest to:

Definitions:

Breach Of Contract

A failure to perform any promise that forms all or part of a contract.

Condition Precedent

A condition that must be fulfilled before a contract becomes effective or before an obligation is required to be performed.

Injunction

A legal directive mandating that a person or organization either perform or halt a particular act.

Compensatory Damages

financial awards given to a plaintiff to reimburse actual losses, expenses, or suffering due to the defendant's wrongful act.

Q1: The amount that Ford Motor Company will

Q13: What is the expected payoff for Little

Q15: Market-based pricing does not consider what the

Q23: Taggart Transcontinental currently has a bank loan

Q32: Which of the following statements is FALSE?<br>A)The

Q38: What is the NPV of an investment

Q39: The IRR of manufacturing the armatures in-house

Q46: If the expected return on the market

Q78: Which of the following statements regarding arbitrage

Q79: What is a sunk cost? Should it