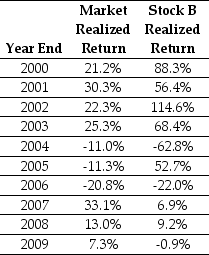

Use the table for the question(s)below.

Consider the following realized annual returns:

-Using the data provided in the table,calculate the average annual return,the variance of the annual returns,and the standard deviation of the average returns for Stock B from 2000 to 2009.

Definitions:

Economic Profit

The difference between total revenue and total costs, including both explicit and opportunity costs.

Investment Return

The gain or loss on an investment over a specified period, usually expressed as a percentage of the investment's cost.

Capital Income

Income earned on savings that have been put to use through financial capital markets.

Dividends

Payments made by a corporation to its shareholder members, typically from profits.

Q9: Your estimate of the asset beta for

Q12: Equity in a firm with debt is

Q13: What is the variance on a portfolio

Q27: Which of the following cash flows are

Q37: You expect KT Industries (KTI)will have earnings

Q44: Suppose that you are holding a market

Q65: Suppose the risk-free interest rate is 4%.If

Q72: The variance on a portfolio that is

Q72: Which of the following statements is FALSE?<br>A)Expected

Q99: The expected return on the market portfolio