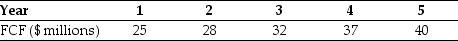

Use the information for the question(s) below.

You expect CCM Corporation to generate the following free cash flows over the next five years:  Following year five,you estimate that CCM's free cash flows will grow at 5% per year and that CCM's weighted average cost of capital is 13%.

Following year five,you estimate that CCM's free cash flows will grow at 5% per year and that CCM's weighted average cost of capital is 13%.

-The enterprise value of CCM corporation is closest to:

Definitions:

Cutting Edge Corporation

A hypothetical or referred company known for being at the forefront of innovation within its industry.

Defective

Describes a product or good that fails to meet acceptable standards of quality, safety, or performance.

Binder

A temporary insurance contract that provides coverage until a formal, permanent policy is issued.

Trustworthy Insurance

Insurance services provided by a company that is reliable and deserving of trust, emphasizing fair practices and clear policies.

Q2: Suppose you plan to hold Von Bora

Q31: The NPV for this project is closest

Q31: You are considering investing $600,000 in a

Q42: If your income tax rate is 30%,then

Q43: Which of the following statements is FALSE?<br>A)The

Q61: At an annual interest rate of 7%,the

Q74: The NPV of project B is closest

Q82: The incremental cash flow that Galt Motors

Q86: Ignoring the original investment of $5 million,what

Q96: Which of these bonds sells at a